Alcohol tax implications for pubs on Shotley peninsula explained by experts

By Guest author 1st Aug 2023

With alcohol duty set to increase today (1st August2023), finance specialists, RIFT, have launched a petition to reinstate the freeze in place since Autumn Budget 2020 to help Britain's beleaguered pub trade, as the cost of some of our favourite pub tipples is set to climb by as much as £1.30.

Experts RIFT explain how the price of our favourite tipples in pubs on the Shotley peninsula is set to climb by as much as £1.30, putting more of our drinking establishment at risk of closure

Some have already taken moves ahead of the new rates with the Red Lion at Chelmondiston for example, bringing in Stella Artois as its premium lager, as it has lowered his ABV to below five %.

This Saturday (5 August) is World Beer Day, but our pubs could be forgiven for not wanting to celebrate, as today, the Government will remove the freeze on alcohol duty that has been in place since the Autumn Budget 2020.

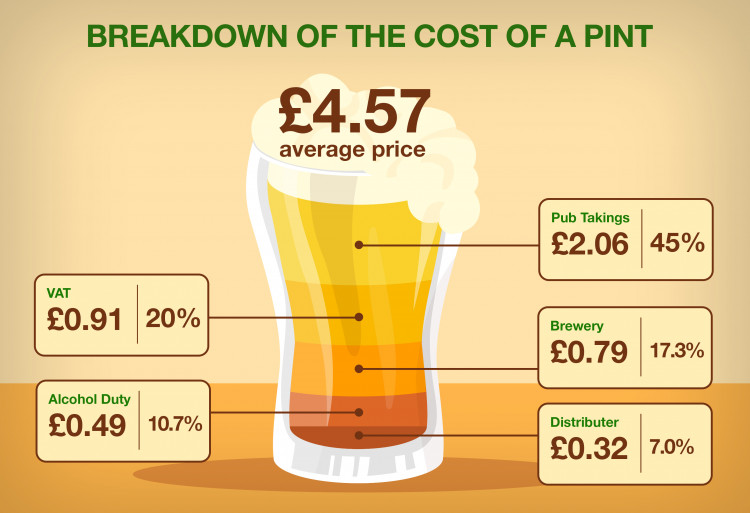

Breakdown of a pint

RIFT has broken down the price of a pint to highlight that even with the freeze on alcohol duty and Draught Relief, pints are far from profitable.

The breakdown shows that the average cost of a pint is currently £4.57. Before it even reaches the pump, £1.11 of this goes towards the brewery (79p) and the distributors (32p). A further 91 pence is paid in VAT, with 49 pence paid in alcohol duty.

In total, £2.51 is paid from a pint before the pub takes its remaining £2.06 share. However, this £2.06 isn't pure profit, it also has to cover costs such as the rent on the premises, running costs such as energy bills and staff wages.

How much is paid to HMRC in alcohol duty?

Alcohol duty is the tax levied by HMRC on all alcoholic products such as beers, cider, wine and spirits.

Analysis by RIFT shows that total alcohol duty paid to HMRC climbed from £7.6m in 2003/04 to £12.1m in 2020/21 - a 60% increase. At the same time, alcohol duty as a proportion of all HMRC receipts during 2020/21 sat at 2.1%, the second highest level seen in the last two decades.

During the Autumn Budget 2020 and the height of the pandemic, the Government decided to freeze the rate of alcohol duty to hand the hospitality sector a lifeline, with a six month extension granted in December of last year and applicable from 1 February to 1 August 2023.

The benefit of the freeze on alcohol duty

Following the freeze implemented in the 2020 Autumn Budget, total alcohol duty paid as a proportion of all HMRC receipts fell to 1.8% in 2021/22, the lowest annual proportions seen in the last 20 years. It then fell further, with alcohol duty accounting for just 1.6% of all HMRC receipts last year (2022/23).

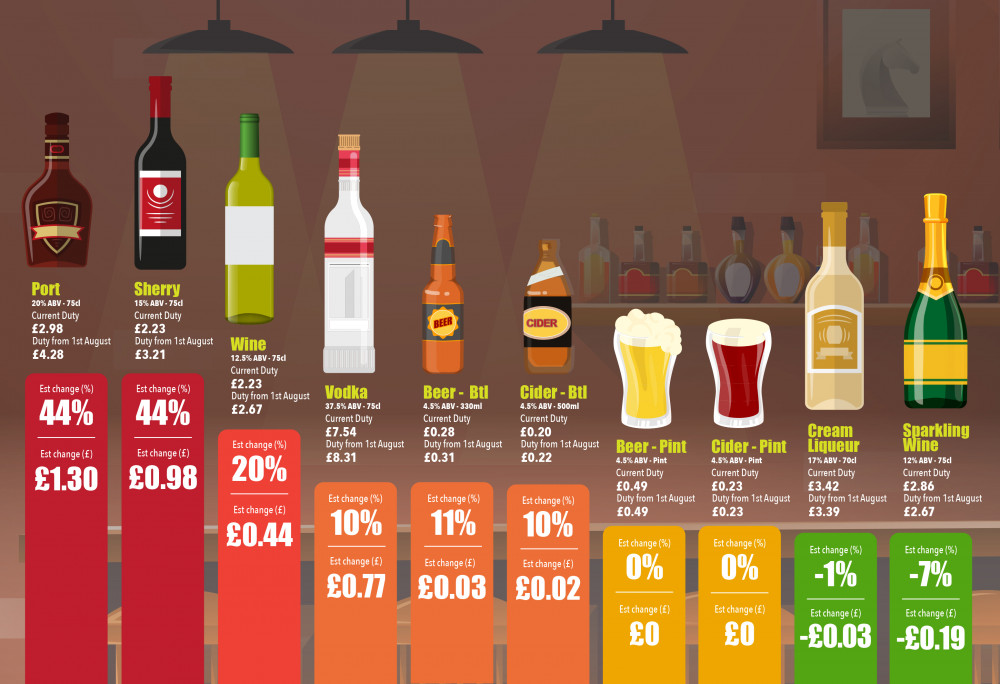

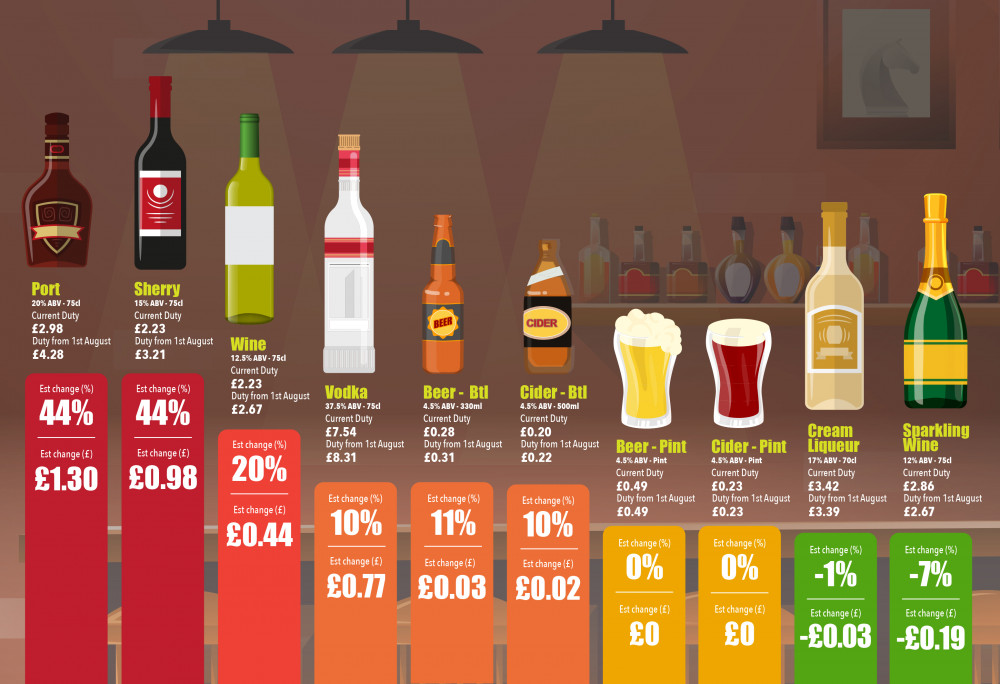

What drinks are due to see an increase?

As of today, 1st August, the freeze in alcohol duty will come to an end, meaning that the duty owed on many of our favourite beverages from the boozer will climb, further reducing the profit margin of the nation's pubs who are likely to have little choice but to pass this price hike onto the consumer.

Fortified wines such as port (+£1.30) and sherry (+98p) are set to see the largest increase, climbing by 44% per bottle. A bottle of vodka is set to increase by 77 pence per bottle, while a bottle of wine is due to increase by 44 pence.

Bottles of beer (+3p) and cider (+2p) are also due to increase in cost but there is some good news for the nation's pint lovers.

While the freeze on alcohol duty is set to end, pubs will see an increase in the value of Draught Relieffrom 5% to 9.2%, which will reduce the tax burden on draught beers and ciders under 8.5% ABV and in containers of at least 20 litres

However, further research by RIFT shows that while this means the duty owed on a pint will remain static, pubs are already being squeezed at the pump, taking just 45% of the price charged on a pint.

Duty hike could shut more pubs

Previous research by RIFT found that some parts of Britain have seen as many as 69 local pubs close their doors in the past two years.

With the nation's pubs already struggling to make ends meet due to high energy prices, the cost of living crisis, and dented consumer confidence as a result of the current economic landscape, there are fears that the increased cost of alcohol duty could cause more to shut their doors.

Petition to reinstate the freeze on alcohol duty

RIFT has launched a petition to urge the Government to consider reinstating the freeze on alcohol duty, to help the nation's pubs negotiate the current economic turmoil and to prevent more from calling time at the bar for good.

Find out more about RIFT's Petition here.

Bradley Post, MD of RIFT, said: "The pub trade and wider hospitality industry was decimated during the pandemic but it's fair to say that they were struggling before Covid came along and this struggle is set to become all the greater with the freeze on alcohol duty ending.

Even with the current freeze in place and the soon to be introduced Draught Relief, pubs pocket less than half of the cost of a pint and they still need to cover their own costs before they can make a profit.

They simply don't have the wiggle room to absorb a further increase in alcohol duty due on other products and so the unfortunate reality is that this increase will be felt by the consumer.

With households still struggling with the high cost of living, the jump in the cost of our favourite tipple is likely to dampen appetites and a drop in customer spending could spell the end for many of the nation's pubs.

The pub is a British institution and we can't allow this to happen, so we're petitioning the Government to reinstate the freeze on alcohol duty and we ask that you help support the cause by signing it."

Data tables

CHECK OUT OUR Jobs Section HERE!

shotleypeninsula vacancies updated hourly!

Click here to see more: shotleypeninsula jobs

Share: